TRADE.com

-

Trading Speed

-

Account Types

-

Trading Platform

-

Customer Service

-

Banking

Summary

TRADE.com is an online broker with some of the most advanced trading tools and software for any novice or expert trader to use. Learn more about this broker in our TRADE.com review or visit them in the link below.

What is TRADE.com?

TRADE.com is a multi-asset broker, now offering a wide range of trading and investing services. With a global presence, this company has managed to build an audience of more than 100,000 customers from all around the world.

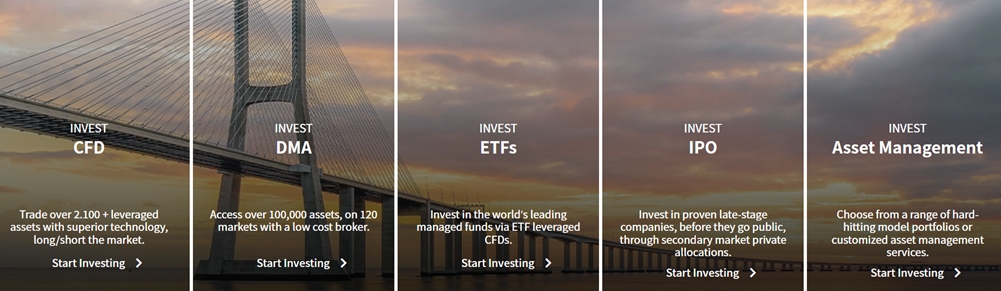

Transparency, performance, and a client-centric approach are just some of the features traders can benefit from. Whether you are interested in CFDs, DMA, ETFs, asset management, or IPOs, each of these services is part of the TRADE.com offering. This review will focus mainly on the DMA offer, because it seems very interesting, but we will not neglect the other avenues traders can take advantage of.

TRADE.com and DMA

First off: what is DMA? It’s a service that allows individuals to buy physical stocks, futures, options, and ETFs, via exchanges such as NASDAQ or LSE. TRADE.com partnered with InteractiveBrokers to facilitate competitive conditions for its customer base.

The DMA offering unlocks access to assets such as:

- Stocks, ETFs & warrants

- Options

- Futures & FOPs

- Fixed income

- Mutual funds

Overall, there are more than 100,000 assets to trade/invest, enough to satisfy a global audience of people with different needs and strategies. The broker grants minimal slippage, so your order is always executed at an optimal price. Also, with multilingual customer support, it’s possible to engage with a representative and sometimes even get assistance in your native tongue.

Other services

Financial markets today are open for practically everyone, and traders are aiming to gain exposure to a variety of assets. TRADE.com addresses those needs by introducing its CFD offering, which enables you to trade on more than 2,100 popular instruments. There are multiple CFD trading accounts available to choose from, and the minimum deposit requirement is set low, so literally anybody can start trading live.

Investing in IPOs is another option when working with this broker. New, innovative companies are constantly popping up, and this means a whole lot of investing opportunities. You might not have enough time or expertise to analyze financial assets and build a portfolio. If that’s the case, TRADE.com introduces the asset management service, offering the ability to choose from a range of customized model portfolios, depending on your goals.

TRADE.com is a regulated brand, currently licensed across multiple jurisdictions. Entities like CySEC, FCA, and FSC have already granted operating licenses for the broker, which means traders signing up benefit from strong financial security, transparency, and privacy.

Customer funds are kept in Tier 1 banks, segregated from funds owned by the broker. You also benefit from negative balance protection and a high standard of account management service.

Conclusion

To sum up, TRADE.com puts competitive trading terms on the table for its DMA service, as well as plenty of other investing/trading solutions for customers who wish to have a diversified exposure. Regulated and transparent, the broker has been around for an extended period, which leads us to the conclusion that we can whole-heartedly recommend it.