Bitcoin has remained under the $19,000 line during trading on Monday in the Asian market. This is with fears regarding inflation and increasing interest rates that drove selling pressure throughout a lot of assets in the market.

Maintaining Status Quo

XRP dropped a few points, but it remains ahead for the beginning of the week thus far. Ethereum and other tokens in the market’s top 10 by their market cap also lost weight as Solana saw the deepest loss on the day.

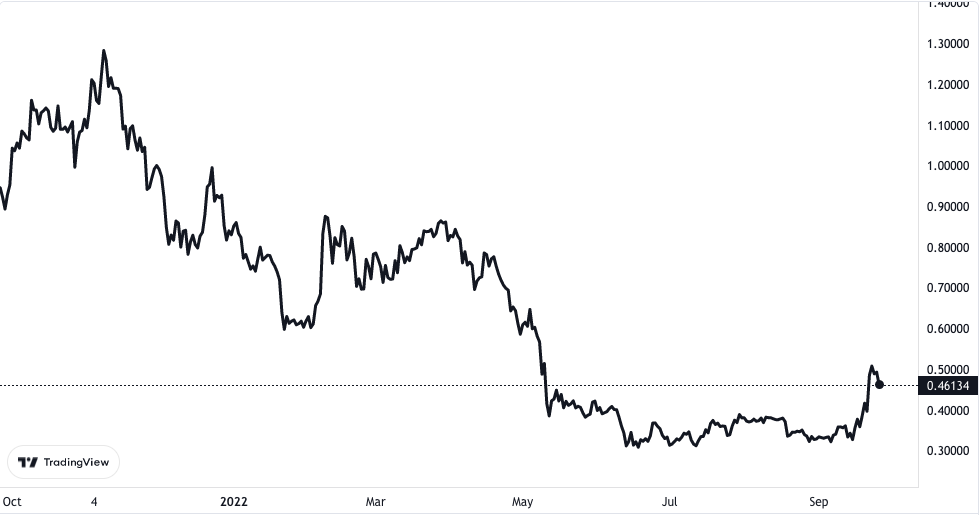

XRP/USD price chart. Source TradingView

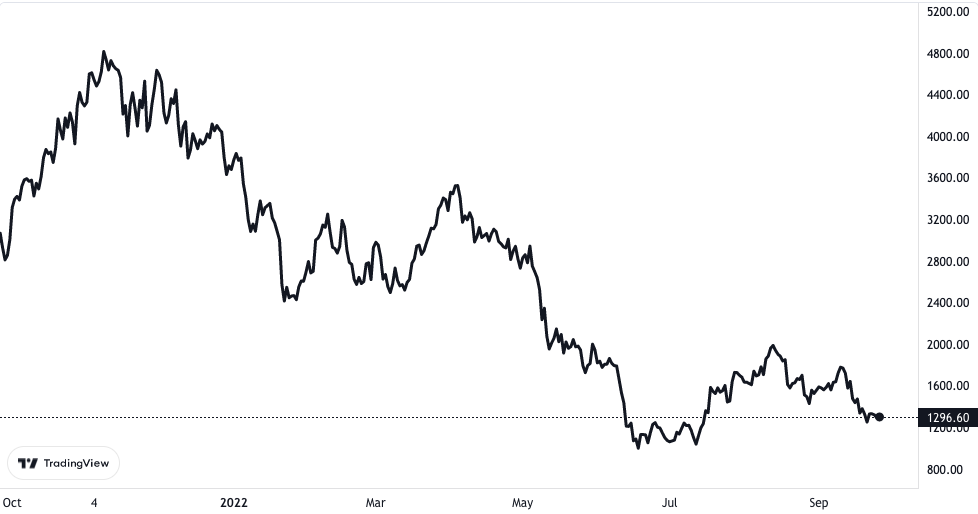

The facts on the ground have it that Bitcoin dropped by 0.98% within the last 24 hours as it now sells at $18,852 in the global market while Ethereum lost up to 2.45% and sells at $1,298 according to TradingView.

XRP pulled back on gains it made in the past week and lost by 3.30% to sell at $0.46134. Nevertheless, the asset is still trading at $35.16% higher than its level before the recent rally. XRP’s latest price spike that began last week was triggered by the hope that Ripple’s legal faceoff with the US Security and Exchange Commission was coming to an end, very likely, without the need for a trial.

BTC/USD price chart. Source TradingView

Solana, on another hand, lost 4.17% to trade at $32.48. That made it the biggest loser of the first ten crypto assets by market cap. It was closely followed by Dogecoin which lost 3.76%.

Central Banks Follow the Feds

The equity market in Asia fell again and prolonged its losing trajectory from when this round started on Friday. It began as a result of market-wide fear over inflation, increasing interest rates from central banks, as well as developments from the war in Ukraine.

ETH/USD price chart. Source TradingView

Japan’s Nikkei 225 index lost 2.66% to hit a low level of two months whereas the Kospi Index in South Korea fell by 3.02%. the Shanghai index fell by 1.2% and the Hang Seng index in Hing Kong lost 0.44%.

Hong Kong’s Monetary Authority, which acts as the central bank for the city, also increased interest rates last week by 75 basis points. It took its cue from the US Federal Reserve that did the same thing so it could curb the rampaging inflation rate. Other central banks like those of Taiwan and the Philippines equally raised rates last week.